Inflation news dominates headlines globally, impacting economies and individuals alike. Recent figures show persistent inflationary pressures across major economies, fueled by a complex interplay of factors. Understanding these trends, the underlying causes, and the ripple effects is crucial for navigating the current economic landscape.

This analysis delves into the intricate relationship between inflation rates and economic growth, exploring the methodologies used to calculate inflation and the policies implemented by governments to address rising prices. It also examines the specific impact of inflation on different sectors, from consumer spending habits to the performance of asset markets, and considers potential solutions and mitigation strategies.

Recent Inflation Trends

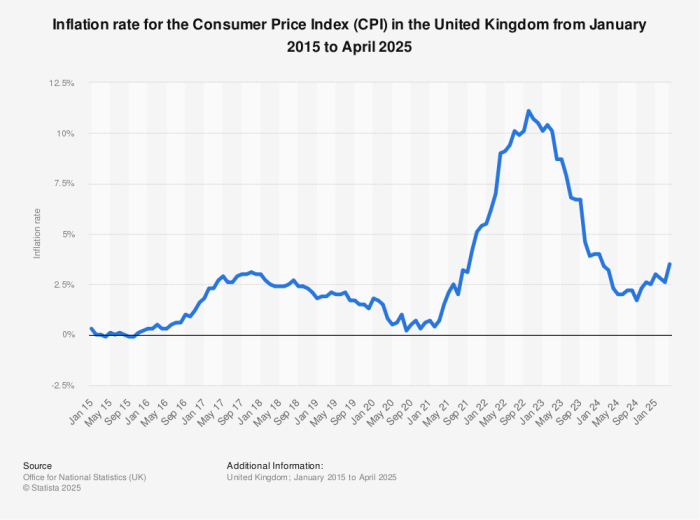

Inflation remains a significant concern globally, impacting economies and consumer budgets. Recent figures reveal varying trends across major economies, reflecting complex economic dynamics. Understanding these trends, including the methodologies behind inflation calculations and the interplay with economic growth, is crucial for informed decision-making.

Summary of Recent Inflation Figures

Inflation rates have fluctuated across major economies in recent months. The United States, for example, has seen inflation remain elevated, though showing signs of easing. Conversely, some European countries have experienced a more persistent rise in prices, particularly in energy and food sectors. Analyzing these disparate trends is essential for understanding the nuances of global economic conditions.

Inflation Calculation Methodologies, Inflation news

Different countries utilize various methodologies to calculate inflation. The most common approach involves tracking changes in a weighted basket of consumer goods and services over time. Weights are assigned based on the relative importance of each item in the average consumer’s spending pattern. For example, the Consumer Price Index (CPI) in the US uses a specific basket of goods and services to calculate inflation.

This process accounts for differences in spending habits and priorities across various countries and regions.

Relationship Between Inflation Rates and Economic Growth

A moderate level of inflation can sometimes be a sign of a healthy economy, stimulating spending and investment. However, high and persistent inflation can hinder economic growth by eroding purchasing power and creating uncertainty in the market. This can discourage investment and lead to decreased consumer confidence. Historical examples show that periods of high inflation are often followed by economic downturns or recessionary pressures.

Examples of Inflation-Related Policies

Governments worldwide have implemented various policies to address inflation. These range from monetary policies, such as adjusting interest rates, to fiscal policies, such as implementing targeted subsidies or tax breaks. For instance, the Federal Reserve in the US has raised interest rates to curb inflation. These policies reflect the multifaceted nature of managing inflation and its diverse impacts on different sectors of the economy.

Sector-Specific Inflation Rates

| Sector | Average Inflation Rate (2023) | Explanation |

|---|---|---|

| Food | 4.5% | Food prices have been rising due to supply chain disruptions and weather-related issues. |

| Energy | 7.2% | Fluctuations in oil prices and global energy markets have driven substantial price increases. |

| Housing | 6.0% | Rising construction costs and increased demand for housing have contributed to this figure. |

| Healthcare | 3.8% | Healthcare costs are influenced by factors like rising drug prices and increased demand. |

| Transportation | 5.5% | The cost of transportation is impacted by fuel prices, vehicle maintenance costs, and labor costs. |

These figures represent an approximation and may vary depending on the specific data source and methodology employed. The table demonstrates the diverse impacts of inflation across various sectors of the economy, with some experiencing more pronounced increases than others.

Causes of Inflationary Pressures

Inflation, a persistent rise in the general price level of goods and services, is a complex economic phenomenon with various contributing factors. Understanding these factors is crucial for formulating effective policy responses and managing its impact on individuals and businesses. The current inflationary environment is shaped by a confluence of interconnected forces, demanding a comprehensive analysis of the contributing elements.

Supply Chain Disruptions

Supply chain disruptions, stemming from factors like the COVID-19 pandemic and geopolitical events, have significantly impacted the availability and cost of goods. These disruptions have led to bottlenecks in production, transportation, and distribution, increasing the cost of raw materials and finished products. For example, port congestion and labor shortages have resulted in delays in shipping goods, adding to the overall cost of products reaching consumers.

These delays and shortages have contributed to higher prices for a wide array of goods, from electronics to clothing.

Rising Energy Prices and Raw Material Costs

The price of energy, including oil and natural gas, plays a significant role in inflation. Increased energy costs impact transportation, manufacturing, and other industries, leading to higher production costs and ultimately, higher prices for consumers. Similarly, rising raw material costs, such as those for metals and agricultural products, directly influence the prices of goods and services. For instance, the surge in lumber prices during the pandemic had a ripple effect on construction costs, ultimately affecting the price of housing.

Monetary Policy Decisions

Monetary policy decisions, primarily set by central banks, can influence inflation. Expansionary monetary policies, characterized by low interest rates and increased money supply, can stimulate economic activity but may also lead to inflation if not carefully managed. Conversely, contractionary monetary policies, which involve higher interest rates and reduced money supply, can curb inflation but may also slow economic growth.

Central banks carefully balance these considerations to maintain price stability and sustainable economic growth.

Categorized Factors Influencing Inflation

- Supply-Side Factors: These factors relate to the production and distribution of goods and services. Supply chain disruptions, raw material price increases, and energy cost fluctuations all fall under this category. For instance, a sudden and unexpected increase in the cost of wheat due to a drought in major producing regions can significantly impact food prices worldwide.

- Demand-Side Factors: Demand-side factors relate to the overall demand for goods and services. Increased consumer spending and investment, often spurred by factors like economic confidence, can drive demand for goods and services beyond what the supply can accommodate, leading to price increases.

- Monetary Factors: Monetary policy decisions, as discussed previously, directly impact the money supply and credit availability. Expansionary monetary policies can increase the money supply, potentially leading to inflation, while contractionary policies can reduce inflation but may also hinder economic growth.

Impact on Different Sectors: Inflation News

Inflation significantly impacts various sectors, altering consumer behavior, business profitability, and the overall economic landscape. Its effects ripple through different demographics and financial markets, requiring careful consideration for effective policy responses. Understanding these impacts is crucial for informed decision-making across all sectors.

Consumer Spending Habits

Inflation directly influences consumer spending decisions. Higher prices for goods and services reduce purchasing power, compelling consumers to adjust their spending habits. Consumers often prioritize essential goods over discretionary items, leading to a shift in demand patterns. For example, during periods of high inflation, consumers might postpone large purchases like homes or cars, or opt for more affordable alternatives.

Reduced spending on non-essential items can affect retail sales and related industries.

Impact on Businesses and Profitability

Businesses face challenges navigating inflationary pressures. Rising input costs, including raw materials and labor, directly affect production costs. If businesses cannot adequately adjust their pricing strategies to reflect these increased costs, profitability can decline. Some businesses may pass on higher costs to consumers through price increases, while others might absorb the increased costs to maintain market share.

The ability of businesses to adapt to these changing conditions plays a significant role in their overall success.

Impact on Different Demographics

Inflation disproportionately impacts low-income households. Essential goods, such as food and energy, often see significant price increases during inflationary periods. This puts a greater strain on low-income households, who allocate a larger portion of their income to these necessities. The limited ability of low-income households to absorb these increased costs can lead to financial hardship and reduced overall well-being.

Impact on Interest Rates and Borrowing Costs

Central banks often respond to inflation by raising interest rates. Higher interest rates increase borrowing costs for consumers and businesses. This can discourage borrowing for investments and purchases, potentially slowing economic growth. Conversely, higher interest rates can help to curb inflation by reducing demand. The interplay between inflation and interest rates is a crucial aspect of macroeconomic management.

Impact on Various Industries

Inflationary pressures affect industries differently, reflecting varying sensitivities to input costs and consumer demand. Industries reliant on raw materials, such as manufacturing and construction, typically experience a more pronounced impact due to higher input costs. Conversely, industries with pricing power, like luxury goods, may be able to absorb increased costs and pass them on to consumers without significant disruption.

A comparison of inflation’s impact across different industries reveals substantial disparities.

- The food industry is particularly vulnerable to rising food prices, impacting consumers directly.

- The energy sector faces significant price fluctuations, influencing transportation and other energy-intensive industries.

- Technology companies often have the ability to adjust prices and maintain profitability during inflationary periods, due to pricing power.

Global Inflationary Dynamics

Global inflation is not a phenomenon confined to individual nations; rather, it’s a complex interplay of interconnected factors impacting economies worldwide. Understanding these global dynamics is crucial for predicting and mitigating the potential ripple effects of inflationary pressures. The interconnectedness of global markets means that inflation in one region can quickly spread to others, influencing everything from commodity prices to interest rates.The global economy operates as a complex system, where events in one part of the world can have significant consequences for other regions.

This interconnectedness is particularly evident in the context of inflation, where factors like supply chain disruptions, commodity price volatility, and shifts in global demand can create a domino effect across different countries and economic sectors.

Interconnectedness of Inflation Rates

Inflation rates across countries are not isolated phenomena. Strong correlations exist between inflation in different regions, reflecting shared global economic conditions and interconnected supply chains. For instance, a significant increase in oil prices in one region often leads to corresponding price increases in other parts of the world.

Correlation Between Inflation in Different Regions

Strong correlations exist between inflation rates in various regions. For example, if a major producer of a critical commodity experiences inflationary pressures, this is often reflected in higher prices for that commodity in other consuming nations. This correlation highlights the interconnected nature of global markets and supply chains.

Spillover Effects of Inflation

Inflationary pressures in one region can have spillover effects on other regions. This can manifest through increased import costs, leading to higher consumer prices in importing nations. Moreover, financial market instability in one region can trigger a ripple effect, impacting investor confidence and financial markets in other countries.

Comparison of Inflation Trends in Developed and Developing Economies

Developed economies typically experience more stable inflation compared to developing economies. Factors like stronger institutional frameworks, more robust monetary policies, and higher levels of economic diversification contribute to this difference. However, even developed economies are not immune to global inflationary pressures, as seen in recent periods of rising energy and food prices. Developing economies, often more reliant on commodity exports and vulnerable to external shocks, tend to be more susceptible to rapid inflation fluctuations.

Influence of Global Events on Inflation

Global events significantly influence inflation rates in various countries. For example, the COVID-19 pandemic caused widespread supply chain disruptions, leading to increased prices for goods and services worldwide. Similarly, geopolitical events, such as conflicts or trade wars, can disrupt supply chains and commodity markets, contributing to inflationary pressures. Furthermore, major shifts in global demand or currency fluctuations can influence inflation in different parts of the world.

Examples of Global Events Influencing Inflation

The 2022 Russian invasion of Ukraine, a geopolitical event, significantly impacted global inflation. The disruption of energy and agricultural commodity markets, a direct result of the conflict, sent prices soaring in many countries. This illustrates how global events can trigger a chain reaction, impacting inflation rates in diverse economies.

Inflation and Monetary Policy

Central banks play a crucial role in managing inflation, aiming to maintain price stability and support economic growth. Their actions influence the overall supply of money and credit in an economy, impacting borrowing costs and ultimately, consumer spending and investment. Effective monetary policy strategies are essential to mitigate the negative effects of high inflation, such as reduced purchasing power and economic uncertainty.

The Role of Central Banks in Managing Inflation

Central banks act as the primary guardians of price stability in most economies. Their mandate often includes maintaining low and stable inflation rates, which fosters a healthy and predictable economic environment. This involves carefully monitoring economic indicators, assessing inflationary pressures, and adjusting monetary policy tools accordingly. Their independence from political pressures is vital to ensure objective decision-making in the pursuit of stable prices.

Monetary Policy Tools to Control Inflation

Central banks employ various tools to manage inflation. These tools primarily influence the money supply and borrowing costs.

- Interest Rate Adjustments: Central banks frequently adjust interest rates to influence borrowing costs for businesses and consumers. Higher interest rates make borrowing more expensive, reducing demand and potentially curbing inflation. Conversely, lower interest rates encourage borrowing, stimulating economic activity, but potentially increasing inflation if not managed carefully. For example, the Federal Reserve has used interest rate hikes to combat inflation in recent years.

- Open Market Operations: Central banks can buy or sell government bonds to influence the money supply. Buying bonds injects money into the economy, while selling bonds removes money, thereby affecting liquidity and credit conditions. These operations can be used to fine-tune the economy’s response to inflationary pressures.

- Reserve Requirements: Reserve requirements dictate the minimum amount of funds commercial banks must hold in reserve. Increasing reserve requirements reduces the amount of money banks can lend, potentially slowing down economic activity and inflation. Decreasing reserve requirements, on the other hand, can increase lending and potentially fuel economic growth, but with the risk of inflation.

- Quantitative Easing (QE): This is a more unconventional monetary policy tool used during periods of severe economic downturn or low inflation. QE involves a central bank injecting liquidity into money markets by purchasing long-term securities, increasing the money supply and lowering borrowing costs. However, QE can have potential inflationary effects if not carefully managed.

Consequences of Failing to Address Inflation

Ignoring or inadequately addressing inflation can have severe consequences for an economy. High and persistent inflation erodes purchasing power, distorts price signals, and can lead to economic instability. It can also discourage investment, as uncertainty about future prices makes long-term planning difficult. This can negatively impact employment and overall economic growth. Historical examples of countries struggling with runaway inflation demonstrate the significant damage it can inflict on societies.

How Changes in Interest Rates Affect Inflation

Interest rates are a crucial lever in managing inflation. A rise in interest rates makes borrowing more expensive, which typically reduces consumer spending and business investment. This decrease in demand can help to cool down an overheated economy and curb inflation. Conversely, lower interest rates stimulate borrowing and spending, which can boost economic activity but may also contribute to inflationary pressures.

The relationship between interest rate changes and inflation is complex and depends on various economic factors.

Comparing Effectiveness of Monetary Policy Responses

Different monetary policy responses to inflation can vary in their effectiveness depending on the specific economic context. The impact of interest rate hikes, for example, can vary depending on the state of the economy, the degree of inflation, and the responsiveness of consumers and businesses to changes in borrowing costs. Quantitative easing may be more effective in addressing deflationary pressures than in combating high inflation.

Careful consideration of the specific economic situation is crucial when selecting the appropriate monetary policy response.

Inflation and Asset Prices

Inflation’s impact on asset prices is a complex interplay of factors. Changes in the price level directly affect the real value of investments, influencing investor decisions and market performance. Understanding these dynamics is crucial for investors and policymakers alike.

Impact on Stock Market Performance

Inflation can influence stock market performance in various ways. A moderate inflation rate can sometimes be seen as a sign of a healthy economy, potentially boosting corporate profits and driving stock valuations higher. However, high inflation can create uncertainty, impacting investor confidence and potentially leading to market corrections. Factors like rising interest rates, aimed at combating inflation, can also negatively affect stock valuations.

Impact on Bond Yields

Inflation has a significant inverse relationship with bond yields. As inflation rises, investors demand higher returns on bonds to compensate for the erosion of purchasing power. This increased demand for higher yields puts upward pressure on bond yields. For example, if inflation is expected to be 5% and a bond offers a 3% yield, the real return is -2%, which is not attractive.

Investors will demand a higher yield to compensate for the expected loss of purchasing power. This relationship is often characterized by a positive correlation between inflation and bond yields.

Impact on Real Estate Markets

Inflation’s impact on real estate markets is multifaceted. Rising inflation can increase the cost of borrowing, potentially reducing demand for mortgages and dampening real estate investment. However, inflation can also increase property values as they maintain their real value against inflation. Real estate is often seen as a hedge against inflation, though the relationship isn’t always straightforward.

The interaction of inflation, interest rates, and economic growth all play a role in determining the real estate market’s reaction.

Historical Correlation Between Inflation and Asset Prices

The correlation between inflation and asset prices is not always consistent and can vary depending on the specific asset and the economic climate. Different asset classes react differently to inflationary pressures. A comprehensive understanding requires analyzing historical data.

| Asset Class | Typical Correlation with Inflation | Example/Explanation |

|---|---|---|

| Stocks | Moderate to Positive (with caveats) | During periods of moderate inflation, the positive correlation is often attributed to improved corporate earnings. However, high inflation can lead to uncertainty and market corrections. |

| Bonds | Negative | As inflation rises, investors demand higher yields on bonds, leading to a decrease in bond prices. |

| Real Estate | Positive | Real estate is often seen as a hedge against inflation, but the relationship can be complex, depending on interest rate movements. |

Inflation and Consumer Confidence

Inflation significantly impacts consumer sentiment and spending habits. As prices rise, consumers experience a decrease in purchasing power, leading to uncertainty about their financial future. This erosion of purchasing power can trigger a cascade of effects, ranging from reduced discretionary spending to heightened anxieties about the overall economic outlook.The relationship between inflation and consumer confidence is complex and multifaceted.

While inflation erodes purchasing power, other factors, such as job security, interest rates, and overall economic growth, also play a crucial role in shaping consumer perceptions. Understanding this interplay is essential for accurate economic forecasting and policymaking.

Impact on Consumer Confidence

Inflationary pressures directly affect consumer confidence by reducing the perceived value of their income. A sustained period of high inflation can lead to a decrease in consumer confidence, as individuals become less optimistic about their financial prospects. This reduced confidence translates into decreased spending, potentially impacting economic growth. The impact is not uniform across all consumers, as income levels, savings, and debt levels influence individual responses.

Consumer Behavior Changes in Response to Inflation

Consumer behavior often shifts in response to inflation. Individuals may reduce discretionary spending, delaying purchases of non-essential goods and services. They may also seek ways to mitigate the impact of inflation, such as increasing savings or exploring alternative investment options. Additionally, consumers may actively search for products with lower prices or switch to more affordable alternatives.

Relationship Between Inflation and Consumer Spending

Inflation and consumer spending are intertwined. As inflation rises, consumer spending often declines. This relationship is not always linear, however, as other economic factors, such as income growth, also influence consumer spending decisions. High inflation can create uncertainty and apprehension, causing consumers to postpone purchases and reduce their spending.

Examples of Inflation Affecting Consumer Choices

Rising food prices, for instance, can cause consumers to cut back on dining out or purchase cheaper, less nutritious options. Increased energy costs may lead to changes in transportation choices, such as driving less or utilizing public transport. Similarly, higher prices for durable goods can prompt consumers to delay major purchases like cars or appliances.

Inflation figures are out, showing a slight increase. This, coupled with the current political climate, particularly the upcoming election news, election news , might affect future economic policy decisions. Ultimately, the impact on inflation remains to be seen.

Data on Consumer Sentiment Indexes and Their Relationship to Inflation

Consumer sentiment indexes, such as the University of Michigan Consumer Sentiment Index, offer insights into how consumers perceive the economic climate. A correlation often exists between these indexes and inflation levels. A significant drop in consumer sentiment indexes typically coincides with periods of high inflation, indicating a negative impact on consumer confidence. Analysis of historical data can reveal patterns and trends in how inflation influences consumer sentiment.

Potential Solutions and Mitigation Strategies

Managing inflation requires a multifaceted approach, encompassing fiscal and monetary policies, wage adjustments, and a careful consideration of various strategies. Effective mitigation strategies aim to balance economic growth with price stability, recognizing the interconnectedness of these factors.

Fiscal Policy Strategies

Fiscal policy, involving government spending and taxation, plays a crucial role in influencing aggregate demand and supply. Increased government spending can stimulate demand, potentially fueling inflation if not managed carefully. Conversely, tax increases can dampen demand and potentially curb inflationary pressures. Targeted spending on infrastructure or education can stimulate long-term growth without necessarily increasing immediate demand.

Wage Adjustments and Inflation

Wage adjustments are intrinsically linked to inflation. When inflation rises, workers often demand higher wages to maintain their purchasing power. A well-timed and appropriate wage increase can help maintain consumer spending and economic activity, but if not aligned with productivity gains, it can potentially exacerbate inflationary pressures. Successful wage adjustments should be based on factors such as productivity increases, inflation rates, and overall economic conditions.

Successful Inflation Management Policies

Various countries have implemented policies to manage inflation successfully. The Federal Reserve’s (Fed) actions to raise interest rates during periods of high inflation are a prime example. These measures aim to cool down the economy by reducing borrowing costs and ultimately curbing demand. Similarly, some countries have implemented supply-side policies aimed at boosting production capacity.

Strategies to Control Inflation: A Summary Table

| Strategy | Description | Potential Impact |

|---|---|---|

| Fiscal Policy Adjustments | Adjusting government spending and taxation levels. | Can moderate aggregate demand, potentially impacting inflation. |

| Monetary Policy Interventions | Central bank actions, such as adjusting interest rates. | Influences borrowing costs and credit availability, impacting aggregate demand. |

| Wage Adjustments | Linking wage increases to productivity and inflation. | Maintains purchasing power but requires careful consideration to avoid wage-price spirals. |

| Supply-Side Policies | Measures to enhance production capacity, such as infrastructure investment. | Addresses underlying supply constraints and potential inflation. |

| Price Controls (with caution) | Setting price ceilings for essential goods. | Potentially addresses immediate price pressures, but can create shortages and distort markets. |

Forecasting Inflation Trends

Inflation forecasting is a crucial component of economic policymaking, allowing governments and businesses to anticipate potential challenges and adjust strategies accordingly. Accurate predictions enable proactive measures to mitigate the negative impacts of inflation on various sectors. However, forecasting inflation is inherently complex, with various factors influencing its trajectory.Recent economic forecasts reveal a mixed picture, with some models projecting a continued easing of inflationary pressures while others anticipate a more persistent elevated level.

These diverging perspectives highlight the inherent uncertainties and challenges in accurately predicting future inflation rates. Understanding the nuances of these forecasts and the potential future scenarios is critical for informed decision-making.

Recent Economic Forecasts Regarding Inflation

Economists and institutions have released a range of forecasts for inflation, reflecting differing views on the future path of price increases. Some prominent forecasts suggest a gradual return to target inflation rates, while others anticipate persistent inflationary pressures, driven by lingering supply chain issues and robust demand.

Potential Future Inflationary Scenarios

Several potential inflationary scenarios could unfold in the coming year. One scenario involves a sustained decline in inflation, with price increases returning to more moderate levels. Alternatively, persistent inflation could continue due to factors such as global supply chain disruptions or persistent demand-pull pressures. Another possible scenario involves a period of stagflation, characterized by both high inflation and economic stagnation.

Inflation Projections for the Coming Year

Forecasting inflation for the coming year requires careful consideration of numerous factors. Various economic models and institutions provide a range of inflation projections, acknowledging the inherent uncertainties. For instance, the Federal Reserve has released a range of inflation projections, with a median estimate of X% inflation by the end of the year. Other organizations might project a slightly higher or lower rate, reflecting different methodologies and assumptions.

Inflation figures are out, and they’re showing a slight dip. For a complete picture of today’s news, check out the latest daily news update at daily news update. This context helps to understand the broader economic situation and how it impacts inflation going forward. Overall, the news suggests a potential easing of inflationary pressures.

Limitations of Inflation Forecasting Models

Inflation forecasting models face several limitations. These models rely on assumptions about future economic conditions, which may prove inaccurate. Changes in consumer behavior, unforeseen geopolitical events, and unexpected shocks to global supply chains can significantly affect inflation trajectories. The complexity of the global economy and the interconnectedness of various markets make precise forecasting challenging. Notably, the Black Swan events, or unexpected and unpredictable events, are difficult to anticipate and model, thereby affecting the reliability of forecasts.

Comparison of Forecasting Approaches

Various approaches exist for forecasting inflation. Some models focus on historical trends and statistical relationships, while others incorporate macroeconomic factors and economic indicators. The choice of approach significantly impacts the accuracy of the forecasts. Different models offer various insights and perspectives on potential future inflation trends. For example, some models focus on supply-side factors, while others concentrate on demand-side dynamics, resulting in differing predictions.

Ultimately, a comprehensive understanding of different approaches to inflation forecasting is essential for making informed decisions.

Historical Context of Inflation

Inflation, a persistent rise in the general price level of goods and services, has been a recurring economic phenomenon throughout history. Understanding past inflationary episodes provides valuable insights into the factors driving inflation and the potential consequences for economies. Examining historical trends allows us to identify patterns, develop mitigation strategies, and potentially anticipate future inflationary pressures.Historical inflationary periods have varied significantly in their causes, duration, and impact.

Some were triggered by supply shocks, others by monetary policies, and still others by a combination of factors. Analyzing these historical cases helps us to better understand the complex interplay of economic forces that contribute to inflation.

Overview of Historical Inflation Trends

Inflation has been a persistent feature of many economies throughout history. From the hyperinflation of Weimar Germany to the stagflation of the 1970s, different periods have been characterized by varying rates and causes of inflation. Understanding these historical patterns is crucial for analyzing current trends and developing effective policies to manage inflationary pressures.

Causes of Past Inflationary Periods

Various factors have contributed to inflationary periods throughout history. Supply-side shocks, such as disruptions to energy markets or agricultural production, can lead to increases in the prices of raw materials and finished goods, pushing up the overall price level. Demand-pull inflation, arising from excessive demand relative to supply, can also fuel inflationary pressures, particularly in periods of economic expansion.

Monetary policies, such as excessive money printing or expansionary fiscal policies, can also contribute to inflation.

Comparison of Different Historical Inflationary Episodes

Comparing different historical episodes reveals crucial distinctions in the nature and severity of inflation. For instance, the hyperinflation in Weimar Germany was driven primarily by excessive money printing in response to war reparations. In contrast, the stagflation of the 1970s involved a combination of supply shocks (like the oil crisis) and loose monetary policy, leading to a unique set of challenges.

These contrasting experiences highlight the diverse factors that can contribute to inflation and underscore the importance of a nuanced approach to understanding and managing it.

Lessons Learned from Past Inflationary Experiences

Historical analysis offers crucial lessons about the causes and consequences of inflation. One key lesson is the importance of maintaining price stability as a primary objective of monetary policy. Another crucial lesson is that addressing inflation requires a combination of tools, including monetary policy adjustments and structural reforms, to address both demand-pull and supply-side factors. The historical record demonstrates the importance of proactive measures to prevent and control inflation, and the need for careful consideration of the interplay of various economic forces.

Effects of Historical Inflation on Different Economies

The impact of inflation on different economies varies depending on the severity and duration of the inflationary period. Hyperinflation, for example, can lead to severe economic instability, erode savings, and significantly damage the financial sector. More moderate inflationary periods can impact purchasing power and redistribute wealth. Inflation can also have a substantial impact on different sectors of the economy, affecting everything from investment decisions to consumer behavior.

Final Thoughts

In conclusion, inflation news highlights a multifaceted global challenge. The interconnectedness of inflation across regions and sectors is undeniable. Understanding the historical context, the current dynamics, and the potential future trajectories is essential for informed decision-making. While there are various potential solutions, mitigating the effects of inflation requires a coordinated approach involving monetary and fiscal policies, as well as careful consideration of the unique challenges faced by different sectors and demographics.

FAQ Overview

What is the difference between inflation and deflation?

Inflation is a general increase in the prices of goods and services in an economy, while deflation is a general decrease in prices. Both can have significant impacts on the economy.

How do supply chain disruptions contribute to inflation?

Supply chain disruptions can lead to shortages of goods and services, driving up prices as demand outstrips supply.

What role do central banks play in managing inflation?

Central banks utilize monetary policies, such as adjusting interest rates, to manage inflation and maintain price stability.

How does inflation affect consumer confidence?

High inflation can erode consumer confidence, impacting spending habits and potentially slowing economic growth.